Reduced Risk

Bring down the risk with real time APIs and clearance. Integrated tax compliance process from invoice to tax reporting.

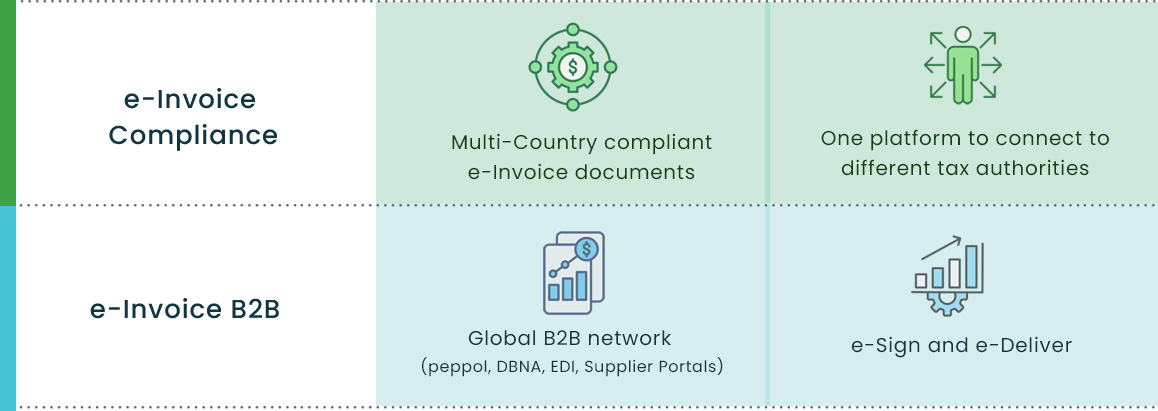

Streamlining AR process with multi-country e-Invoice clearance,

multi-channel

e-Delivery regardless of the receiving capabilities of your customer

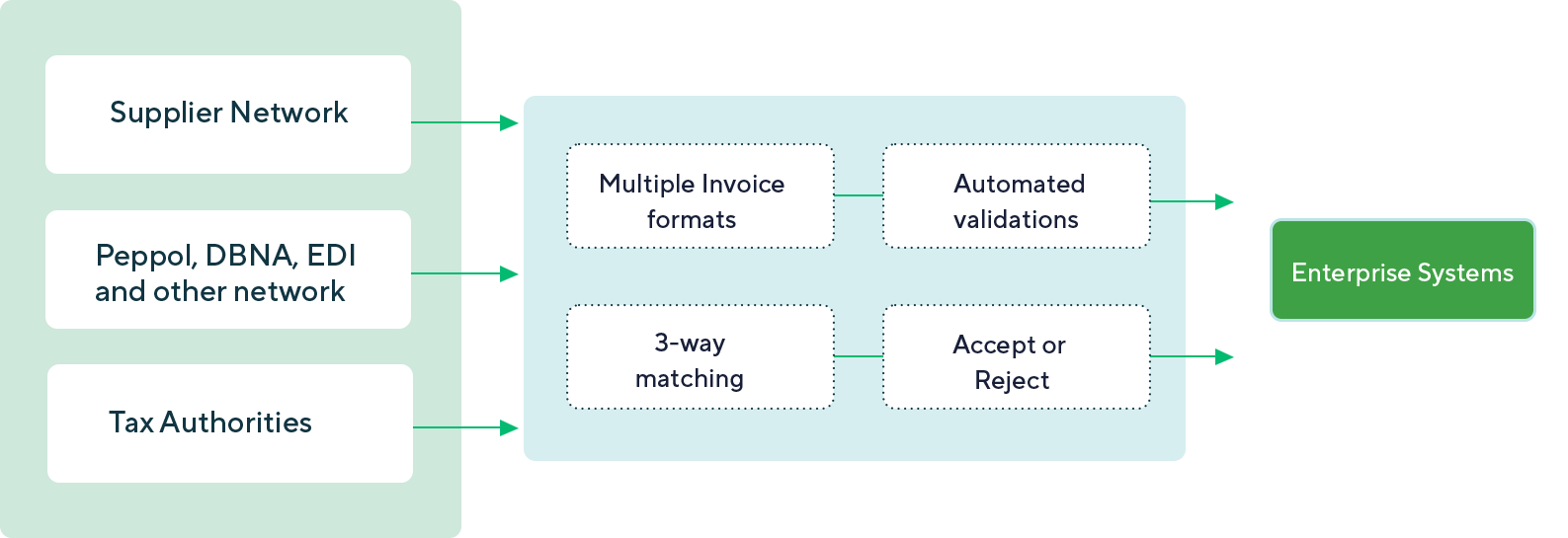

Streamline invoice intake from diverse channels and seamlessly

transfer

validated, compliant invoices to the Accounting system.

Certified Peppol Access Point

ISO 27001:2013 Certified

ISO 9001:2015 Certified

AICPA SOC II Compliant

JDA Authorized peppol access point

VAPT Process Compliant

AU-NZ Authorized peppol access point

Info sec clearance from global companies

SAMA cleared eInvoice provider

Authorized partner for top ERP/FAS

ZATCA Authorized EGS

Keep the source side changes to minimal with ELT for inbound and ETL for outbound. Eliminate change impact by global regulators.

Transform, prepare, compute and report data to regulators or B2B counterparts by bridging with multiple enterprise systems across organization.

Exchange documents, ledgers and processes across department users or B2B partners with collaborative actions using e-Delivery or use network options.

Taxilla offers cluster of independent micro-services that scale independently while working in tandem for each use-case.

Automated data preparation. Dynamic metadata driven UI for timely alert-based user attention to correct erroneous data.

Always available is core to mission

critical applications such as e-Invoice. Taxilla delivers

unmatched throughput with great efficiencies.

Bring down the risk with real time APIs and clearance. Integrated tax compliance process from invoice to tax reporting.

Unified processes across back offices, middle offices and managed services for multi-country e-Invoicing, reconciliations and tax reporting.

Simply your business systems. Reduce complex data transfers between software to improve efficiency and control.

Taxilla's advanced versioning automatically handles new tax rules and reporting requirements.

Automated clearances and financial closures using tolerance rules and process decisioning rules. In near future, auto-populate discrepancy notes.

Consistent data flows across transactions, reconciliations and reporting processes with end-to-end data traceability for accurate reporting.

In today's rapidly evolving business landscape, e-invoicing, has become a crucial element in streamlining..

Understanding diverse e-Invoice models, such as reporting and clearance, is essential for staying compliant as various...

Choosing the right global eInvoicing vendor early is crucial for ensuring compliance ....